Our Story Is Just Your Story

Learn Why This Is Important To You

Why This Isn’t Really About Us

Most retirees we meet have done everything “right.”

They saved. They invested. They followed the advice they were given.

But now they’re realizing something’s off.

Their income feels uncertain. Taxes are creeping up.

Required withdrawals are approaching—and no one’s shown them how to plan for it.

We believe that’s unacceptable.

You deserve better than hope, market timing, or vague percentages.

The Real Problem Isn’t You—It’s the System You Were Given

For decades, the financial industry focused on accumulation:

Grow your assets. Stay diversified. Ride it out.

But retirement isn’t about growing. It’s about withdrawing.

And withdrawing the wrong way—even slightly—can quietly cost six figures.

That’s because retirement comes with entirely new rules:

-Taxes don’t work the same way

-Market losses hurt more when you're drawing income

-And once RMDs begin, flexibility disappears

Yet most retirees are still following a strategy designed for growth—not income.

That’s the flaw we’re here to fix.

Ok... So Who Am I?

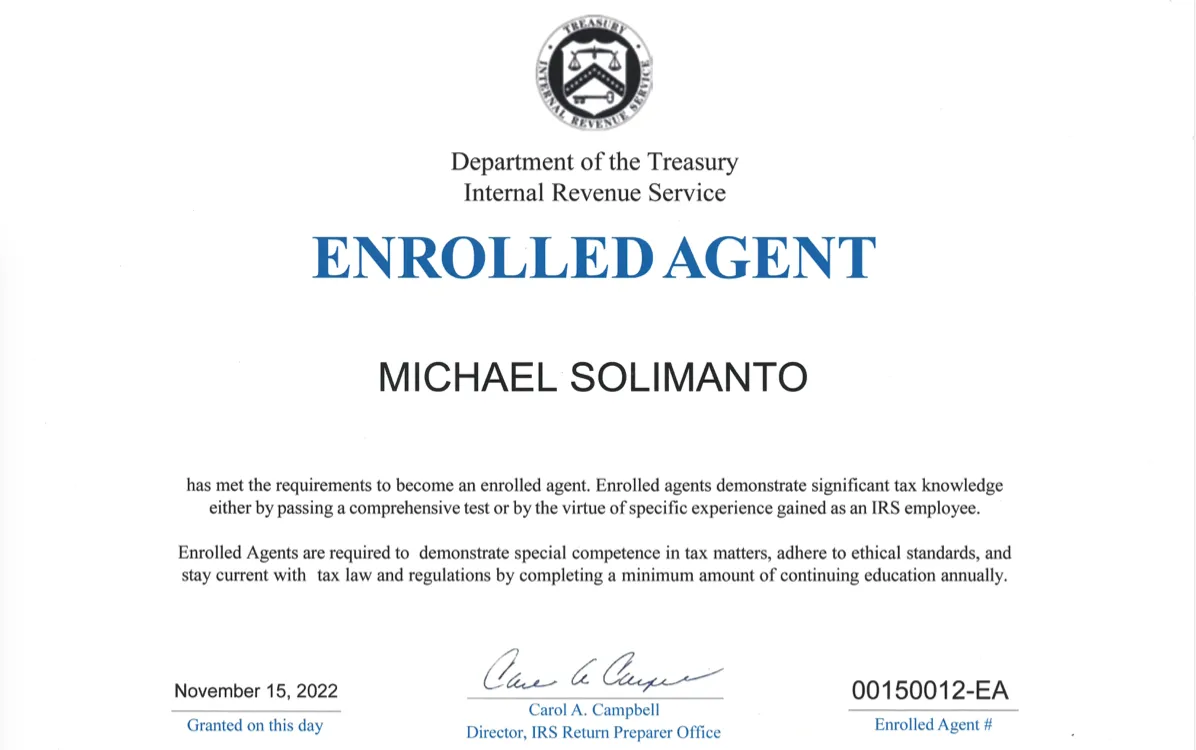

I'm an Enrolled Agent by the US Treasury (the highest credentials on taxes by the IRS), an Amazon Best New Release Author on Taxation who specializes in retirement, and a son who loves his father and watched him struggle in retirement. And here's my credentials in black and white.

Our Mission Is Simple: Build a Smarter Withdrawal Strategy Around You

We help retirees structure their income so they:

✅ Pay less in taxes

✅ Protect against down markets

✅ Don’t outlive their savings

✅ And feel in control—no matter what the market does next

We’re not here to play market roulette.

We’re here to help you build a retirement that works on purpose.

Who We Are

We’re not generalist advisors. We’re tax professionals, retirement income planners, and risk mitigators.

We use economic modeling—not gut feeling—to help retirees turn their savings into stable, predictable, optimized income.

What matters is that every piece of advice we give is focused on one goal:

Helping you keep more, risk less, and retire better.

Why This Matters Now

Every year you wait, your options shrink.

Markets shift. Taxes change. RMDs approach.

The earlier you act, the more flexibility you preserve.

That’s why we do what we do.

If you’re ready for a retirement that’s built to last—on paper and in life—we’d be honored to help.

Let’s take the risk off the table—before it compounds.

Let’s take the risk off the table—before it compounds.

Schedule your free retirement income strategy session below.